When To Cut Your Losing Shares

I think one of the toughest parts of investing, even when you’ve been doing it for a while, is knowing when to sell a losing share. The old saying goes ‘cut your losers, run your winners’ and broadly it’s good advice. Many traders set very tight stop losses, 10% being quite common. I dont think a ‘one size fits all’ method is the best idea for shares though.

On some shares a 10% stop loss is a great idea, but for others maybe not so much. Some shares are very volatile with fairly regular peaks and troughs that may vary by more than 10% each way. In those cases, it’d be sensible to establish the common bottom point for those troughs (which is typically what is known as the support level) and set slightly below that as your stop loss instead. In some cases the share might be the opposite – it might be not volatile at all – in which case the same rule still fits, and in fact means a stop loss of less than 10%. In general careful analysis of the share chart gives you a pretty good idea of how low a share is likely to fall before it should be deemed a problem, so its worth paying attention to this before you even buy the share and then having a firm strategy in mind for how to manage the share once it is purchased.

The big problem with stop losses is the good old fashioned ‘tree shake’. This is where the market makers drop the prices on shares by a fairly large amount to trigger private investors stop losses so that they can hoover up shares at an artificially cheap price – usually to fill large institutional sized orders at a greater profit. For this reason, we dont tend to use automated stop losses but instead rely on our own monitoring of the share and do our own stop losses manually. This way we can avoid falling for tree shakes. Also, we dont tend to sell a share that is falling if its a case of the whole market being on a downswing rather than an individual share. There’s exceptions to that but if its just that the market is having a bad day but there’s nothing specifically going on with the share itself, we’ll give the stock a stay of execution and re-evaluate the next day.

Our share strategy, when it comes to selling at a loss, is quite variable depending on the type of stock:

Momentum/Volatile/Speculative Stocks:

– On these we do typically limit losses to around 10% (or a suitable support level close to it).

– We allow some variance for if the market is falling, what previous lows are etc.

– We feel that if a stock like this has fallen by 10% or more in a steady or rising market then it is more likely to fall further than it is to rebound.

Value and Income Stocks

– If the stock is great value when we bought it, the books all look good, the newsflow is positive etc.. then these stocks we dont start to worry about until they are 20% down.

– If there is a strong dividend then that makes this extra tolerance even easier to cope with and could even allow us to stretch to 25% down.

– As with momentum stocks, there’s some extra variance depending on what the market is doing, what we know about the company and what the previous lows are.

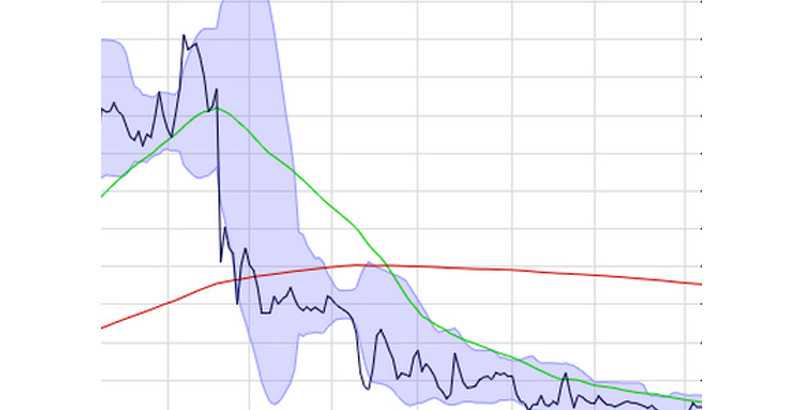

We also watch for the following indicators:

– The Death Cross (when the 50 day moving average line drops below the 200 day moving average line)

– 52 week lows (when the price reaches a new low point compared to the previous 52 weeks)

– The bottom Bollinger line being crossed

– Profit warnings

Any of these signals will usually push us to sell. We didnt used to sell on profit warnings but have learnt from it that one profit warning is usually followed by at least one more and the initial drop in share price from a profit warning is most often followed with further drops. Likewise with serious negative publicity – thanks to the Blinkx/Ben Edelman episode. With that situation we didnt believe that one person’s blog, that the research for was allegedly paid for by short sellers, could have such a profoundly negative effect on a share price and a company’s reputation and we held onto Blinkx for much longer than we should have until eventually no matter how true or untrue the blog content was it spooked enough of Blinkx’s investors and customers that a profit warning was issued and now the share price may never recover. Overall we lost 43% on Blinkx but had we sold at the first sign of trouble we’d have at least halved that. It’s a very valuable lesson that we will not soon forget.

Remember too that if you sell a share, that doesnt mean you’ll never own that share again. You might just be able to buy the same number of shares back a few weeks or months later for 30% less. I think sometimes that’s the problem people have with selling a losing share, they like the company and mentally it feels like you are giving up on owning a piece of that company ever again. But that doesnt have to be the case. ITE is a good example for us, we have bought that share, sold it on a profit of 20% and now bought it back 20p per share cheaper than we bought it for the first time. You can buy and sell a share many times, ideally buying on the lows and selling on the highs.

The take home message is to learn when to sell your losers. Losers that you hold onto, or even that you buy more of to average down, have strong tendency to turn into even bigger losers. Nip them in the bud fairly quickly to avoid this. You can always buy them back later if they start to turn around. If you followed a strategy of investing a fixed amount (say £1000) in every new share you buy, setting stop losses at 10% down and a sell limit order at 30% up, you should in theory only need one in every 4 of your picks to be winners to roughly break even (without going into calculating dealing costs of course). If you follow a careful share picking strategy and let your winners run higher than 30% whilst still fixing your losers at a tight drop, all the while also raking in dividends, then you should be fairly successful.

Footnote:

As an afterthought to this article, I reviewed every share we’ve ever sold at a loss and almost 80% of them have since gone onto even bigger losses as things currently stand. Certainly good evidence for cutting your losses early.