We are truly sorry Quindell, but we’re out – for now...

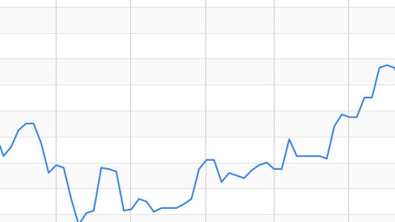

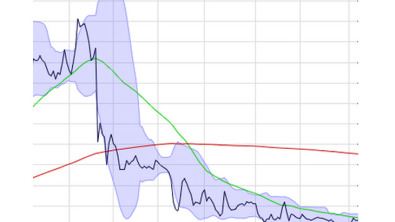

Amongst many shares we sold last week was one of our favourites – Quindell. At one point it was one of our greatest successes, having more than doubled our money, before being put firmly in reverse and dwindling to 40% of our original investment thanks to what is suspected to have been a co-ordinated short selling attack by Gotham City Resear ...